Every morning for 47 years, Gaily Cowart’s mother woke up in her sun-filled bedroom overlooking a lush garden and the San Gabriel Mountains beyond.

That garden and much of her mother’s home are now covered in ash and soot after the Eaton Fire ripped through Altadena on Jan. 7, destroying more than 9,000 residences in the foothill community north of downtown Los Angeles. At least 17 people died, and thousands more were displaced.

Cowart’s childhood house survived the flames but is surrounded by charred homes and razed businesses near what used to be Altadena’s bustling business corridor. The neighborhood off Lake Avenue sustained some of the worst damage in one of two major fires that swept through Los Angeles County in January.

The Eaton and Palisades fires displaced about 150,000 residents, and many remain in rentals and hotel rooms nearly two months later. Survivors whose homes are standing face ballooning smoke remediation and restoration costs, as well as insurance companies that are lowballing payouts even though some offer smoke damage coverage.

NBC News spoke with seven homeowners whose houses survived the fires. Six of them paid for smoke damage coverage through insurance, and one did not have the option through the state’s insurer of last resort.

Still reeling from the destruction, they now face tens of thousands of dollars in costs or more to deep clean and remediate remaining toxins inside their homes. They anticipate being displaced for months as they begin rebuilding.

“It’s really tricky being in a home that did not burn down,” Cowart said. “There’s such a gray area with insurance thinking, ‘Just wipe everything down and it’ll be back the way it used to be.’ But it’s like, 'No, I’ve got soot and ash that I can see with my eyes.'”

The insurance industry has long been fraught in California, where wildfires are getting bigger and deadlier every year. Major insurance companies have stopped writing new policies or are refusing to renew existing ones to offset skyrocketing costs across much of the state.

Residents were blindsided last year when State Farm, California’s largest insurer, announced it would drop coverage for 72,000 houses and apartments. It blamed costs associated with inflation, catastrophe exposure, reinsurance and regulations for its need to protect its bottom line.

On Friday afternoon, Altadena resident Andrea-Marie Stark emerged from a State Farm information tent frustrated by the lack of progress in getting her remediation estimate approved. Service was scheduled to start Monday on her three-bedroom, two-bathroom ranch-style house facing Eaton Canyon, where the fire was first reported.

But State Farm had not yet approved the estimate, which ranged from $80,000 to $100,000 to pull insulation from the walls, remove harmful particles from all surfaces and replace furniture, clothing and appliances exposed to excessive smoke and ash.

“I’m worried I’m going to lose my place in line,” Stark said of the approval delay. “And then I could lose a place to live.”

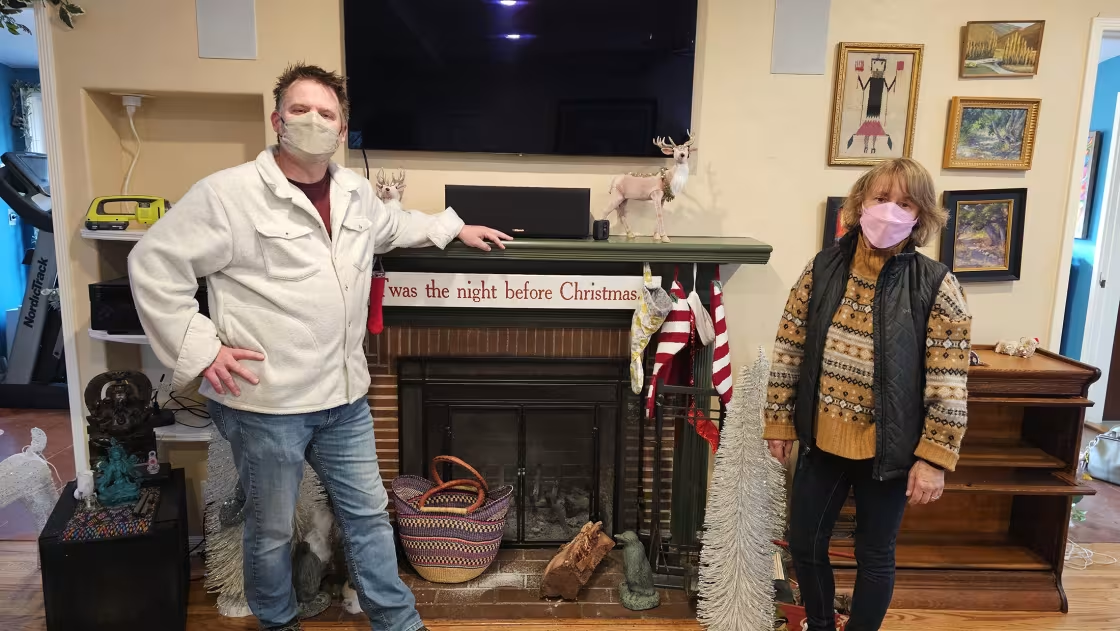

Stark’s house is one of several that survived the inferno on her block, but its proximity to the flames meant everything inside was coated with a thick layer of soot. Christmas decorations turned gray in the ash, and her clothing has the strong odor of smoke.

A charred smoky smell lingers on Stark's street. A neighboring house has been razed to its foundation, with only the chimney left standing. In the distance, green moss and leaves sprout amid the burned branches and fallen limbs of Eaton Canyon.

Stark and her husband evacuated to a friend’s home the night of the fire after they secured their four rabbits, five chickens, three cats, a dog and a horse in their crates. They have been jumping from friend’s home to friend’s home ever since. They hoped to return to Altadena by mid-March after having booked a smoke remediation company that said it could complete the work quickly.

But State Farm had not responded to her claim for two weeks, and she worried she would need to pay for the remediation herself, plus rent if her appointment had to be rescheduled.

In an emailed statement, State Farm said it is “committed to paying what we owe, promptly, courteously, and efficiently.” As of Feb. 26, it has received more than 11,750 fire and auto claims related to the fires and paid nearly $2.2 billion to customers, it said.

To cope with the anxiety associated with surviving a catastrophic event, Stark and her husband started a Monday night support group for residents whose homes are still standing. It is a way for people to speak openly about what few others can understand.

“Safeness is an internal feeling. Safety is external, and they’re both ruptured right now,” said Stark, a trauma-trained counselor. “I don’t want to express this to someone without a home, you know, because I don’t want to disrespect their experience and make them think that I’m not grateful. That’s called survivor’s guilt.”

The smell in Marcie Habell’s Altadena home nauseates her. A remediation company recommended taking it down to the studs to fully restore it. She cannot imagine returning to it right now, let alone sitting on her fabric couch or using any of her towels or linens.

“I can be in my house for less than five minutes," said Habell, whose home is one of just two standing on her block. "It’s insane that it happened, and then on top of it, the way that insurance is behaving just compounds the tragedy.”

She has been quoted upward of $22,000 just for toxicity testing, and she expects rent could run $4,000 to $4,500 a month. That's on top of paying her mortgage if her insurance company does not agree to cover the full cost, she said.

“We are getting zero guidance from anyone for those of us who happen to have a standing home and are surrounded by the apocalypse,” she said.

Michael Sollner, California's deputy insurance commissioner, said in a statement that "smoke damage is real and insurance companies must investigate claims properly, not deny them outright or pressure homeowners into accepting less than they are owed."

More than 33,710 insurance claims related to the Los Angeles-area fires have been filed, and nearly $7 billion in claims have been paid, according to state Insurance Department.

Cowart is handling her mother’s smoke damage claim from Dallas, where she has been living for more than a decade. She flew to Los Angeles on Jan. 8 to pick up her mother from a friend’s house and took her back to Texas. Cowart’s mother, Faye Howard, has early onset Alzheimer’s and struggles with being in a new place. But Cowart fears her old neighborhood is too toxic to return to.

Initial estimates to remediate the Spanish-style two-bedroom, two-bathroom house started at $55,000. A landscaper bid $3,000 to restore the garden and remove potentially toxic soil. Including furniture removal and buying new clothing, Cowart fears, the cost to fully restore her mother’s home and everything in it could quickly top $100,000. Howard’s Allstate adjuster has not finalized their payout or agreed to pay long-term rent while Howard remains displaced, Cowart said.

“My mom doesn’t understand why she can’t go home,” Cowart said. “Just on a basic human level, no one has told us what we’re supposed to be doing.”

Allstate was not available for comment Monday.

Rob Rhatt, an insurance analyst for Lending Tree, said it is “frustrating and not surprising” that insurance companies are slow to handle smoke damage claims. Unlike damage from fires, which is structural and clearly visible, damage caused by invisible smoke does not neatly fall into most categories. It requires professional testing, cleaning and restoration with expensive outside vendors.

Simply put, homes in high wildfire-risk areas are bad for business.

“These catastrophic losses have really cut into their profitability,” Rhatt said of insurance companies. “It’s not just cutting into their profitability where they’re making less money, but it’s actually threatening their solvency to the point where they’re losing money insuring homes in California.”

Pacific Palisades resident Ian Hardcastle said he never had the option to fully insure the 2,600-square foot home he shared with his wife and 14-month-old child near Temescal Gateway Park, where the Palisades Fire sparked.

After they bought their house in 2021, he signed up for the California FAIR Plan, which provides coverage for those who cannot obtain insurance from private companies, and hoped any wildfires would stay tucked in the mountains and canyons, as they had historically.

But on Jan. 7, a wind-driven inferno ripped through the state park behind his house and devastated the surrounding neighborhood. His home was overwhelmed with billowing smoke and toxic ash for several days. Hardcastle can stand to be inside for only a few minutes at a time.

His adjuster quoted $1,826 for remediation, but a $5,000 deductible means Hardcastle will receive no payout for work that could cost much more.

"This, this little plot of land was our special happy place, so we're happy it's still here," Hardcastle said Thursday as he toured his property. "We want to come back, but again, we don't know when that will be."

This story first appeared on NBCNews.com. More from NBC News: